New Zealand general insurance update 2021 – weather, regulation and affordability high on insurers’ minds

As another pandemic year draws to a close, we look back at the events and thinking that shaped the New Zealand general insurance experience. The issues ahead will provide plenty of challenge as leaders tackle climate change, a raft of new compliance changes and increased government scrutiny to ensure a healthy marketplace.

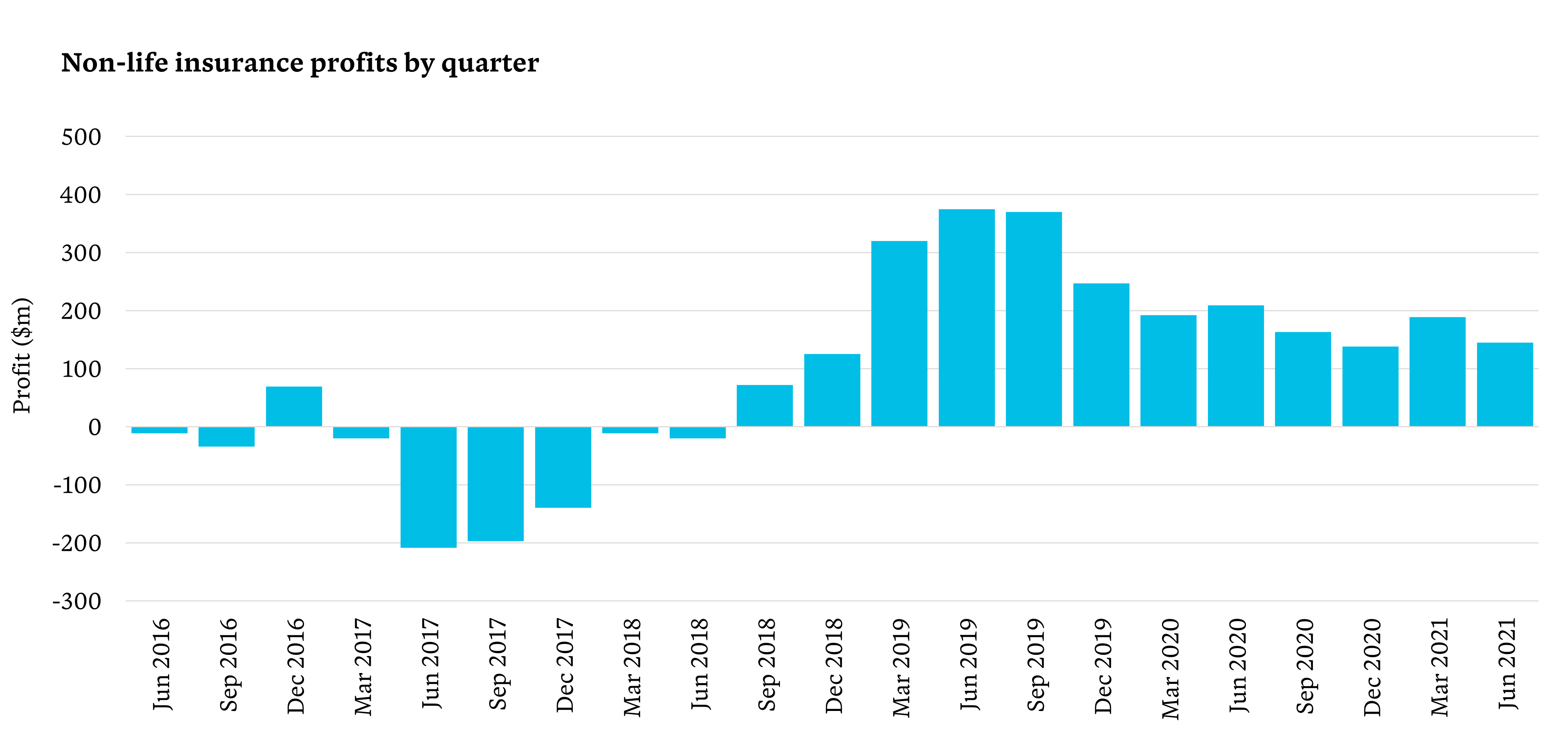

Floods, hailstorms, tornadoes and the Lake Ohau fire, which destroyed 48 homes, caused insurers to take a profitability hit in FY2021. According to the Insurance Council of New Zealand natural disaster list, there were nine major events across Aotearoa estimated at $213 million in total losses. Despite these figures, quarterly data from the Reserve Bank of New Zealand (RBNZ) shows that although the level of profits have declined, general insurers remained profitable over the past year.

This continued profitability of insurers, even with an increase in the number of natural disasters, indicates that past rate increases have resulted in insurers having adequate pricing and reinsurance programs. However, further premium rate increases are likely in the country due to increasing reinsurance rates, with the New Zealand general insurance market covered by a few reinsurers able to pick and choose their exposures. This is in line with hardening premium rates internationally, as consumer demand remains high, while insurer supply and appetite dwindle.

Source: RBNZ Quarterly Insurance Financial Performance

Greater focus on flood risk

Weather-related events have also continued into the second half of 2021, with heavy rain in mid-July causing significant flooding across the country, but with the West Coast being the hardest hit. The current costs for these floods are in excess of $120 million. West Auckland also experienced severe flooding in August 2021.

These events highlight that flood risk is significant for New Zealand general insurance. To date, the introduction of risk-based pricing in the New Zealand market has predominantly focused on earthquake risks. This is due to the higher risk of large losses posed by earthquakes and the availability of sophisticated insurance risk models for earthquakes. Historically, flood models that cover all New Zealand risks have not been available.

In May 2021, RMS, an international catastrophe risk-modelling firm, launched a flood model for New Zealand. In June 2021, financial and data services company CoreLogic updated its flood models that were launched in 2020 to providing 100 per cent coverage and greater detail, down to property level. As the sophistication of risk modelling increases, insurers will be able to adjust their pricing and underwriting to reflect a wider range of risks.

When risk-based pricing gets sophisticated

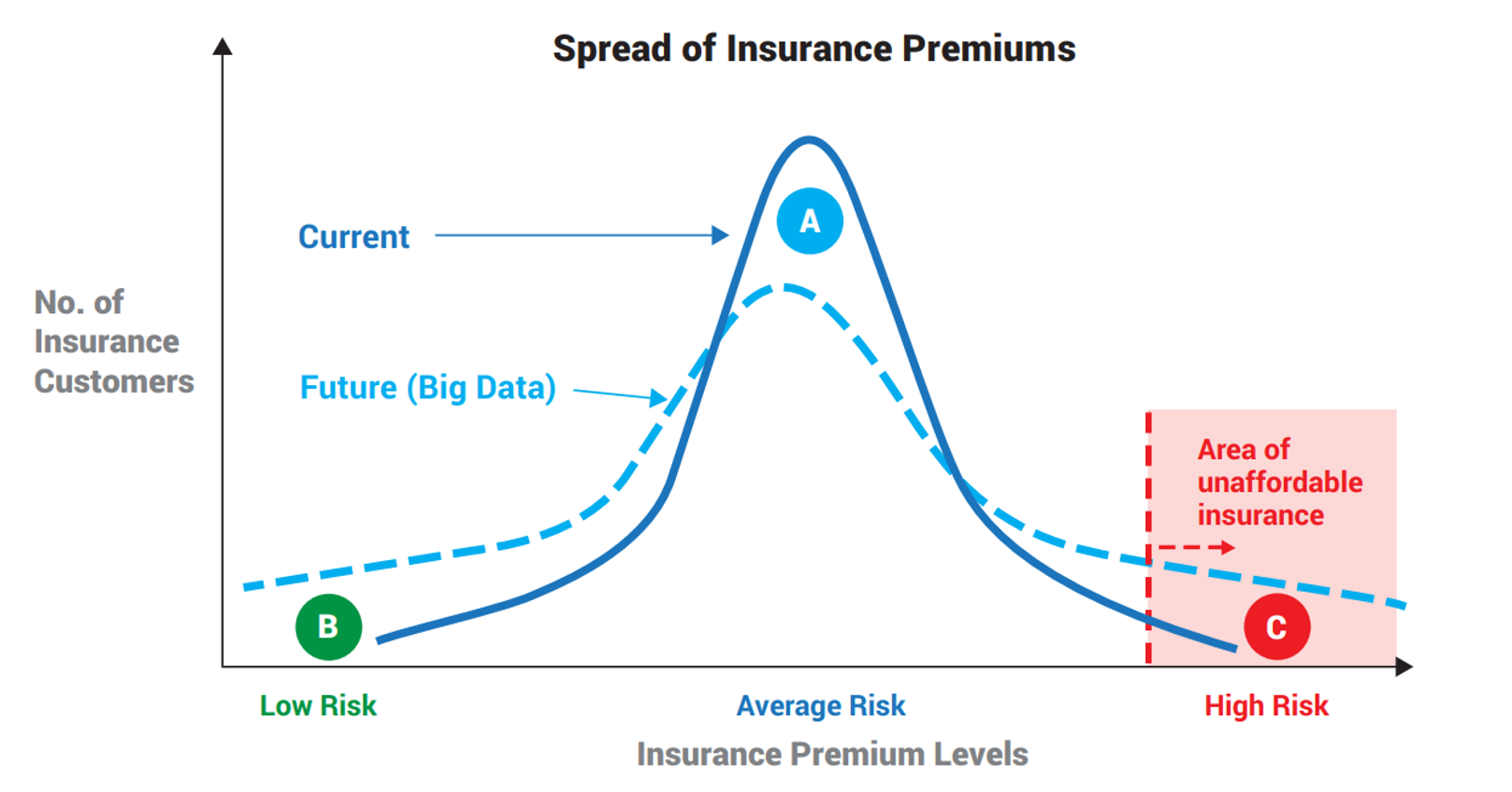

This broadening of risk-based pricing will result in a wider spread of insurance premiums, which means some customers will see a decrease in their premiums and others will see their premiums increase. Those customers that experience the largest premium increases may potentially end up being unable to afford to continue to insure their property.

When increases in risk-pricing results in homes becoming unaffordable, this can result in pressure for the Government to intervene in the insurance market. An example of this is the reinsurance pool for North Australian cyclones and floods, which was announced by the Australian Government in May. With the exception of the Earthquake Commission (EQC), we are yet to see any similar interventions in New Zealand.

Source: The Impact of Big Data on the Future of Insurance, Actuaries Institute of Australia

Warning bells for coastal retreats

One future risk that the Government is considering is coastal erosion. As sea levels rise due to global warming, several coastal properties are expected to become uninsurable. A paper published through the Government’s Deep South Challenge initiative estimated that up to 10,000 homes may be uninsurable by 2050. Minister for Climate Change James Shaw has said the Government will be looking at the options to tackle sea-level rise as part of the Climate Change Adaptation Act (CCA), one of the three acts government is proposing to replace the Resource Management Act.

One of the potential options in response to rising sea levels is managed retreat, where coastal properties are abandoned, and people are resettled in new properties. James Shaw has said the Government hasn’t made any policy decisions yet. However, the Ministry for the Environment’s website says that the CAA will “address the complex and technical issues associated with managed retreat and funding and financing adaptation”. This suggests some form of managed retreat will be implemented. The Government will work closely with insurers and banks in the development of the CCA. There is currently no firm date for when the CCA will be implemented.

Mandatory climate-related disclosures

In the more immediate term, the Government has also announced the introduction of mandatory climate-related disclosures for large insurers. This requirement will apply to licensed insurers with annual premiums of more than $250 million or assets of more than $1 billion. This definition will capture the nine largest general insurers in New Zealand, along with the two largest health insurers. However, insurers who are not captured by the requirements could potentially self-adopt the requirements as well.

At the moment, there are no requirements for reporting on climate change impacts. The Productivity Commission noted in its Low Emissions Economy report that this lack of information has resulted in “ongoing and systemic overvaluation of emissions-intensive activities”. One of the goals of the mandatory disclosures is “to ensure that the effects of climate change are routinely considered in business, investment, lending and insurance underwriting decisions”.

Future risk: government is considering coastal erosion, as sea levels rise with global warming

The requirements of the mandatory disclosure are being developed by the External Reporting Board (XRB). The standards will be based on the 2017 recommendations from the Task Force on Climate-related Financial Disclosures of the Financial Stability Board. These recommendations have four key themes:

- Governance of climate-related risks

- The impact that climate-related risks have on an organisation’s strategy and resilience

- The risk-management processes an organisation has for identifying and managing climate-related risks

- The metrics and targets are used to assess and manage climate-related risks.

The XRB are currently consulting on the proposed governance and risk management sections of the proposed new standard. Further consultation on the strategy and metrics and targets sections of the standard will be held in March 2022. A final consultation on the formal exposure draft will then be held in July 2022, with the final standard expected to be issued in December 2022.

New standard bearers

In July, the RBNZ published the draft Interim Solvency Standards (ISS), as part of its solvency standards review announced in October 2020. The review of the solvency standards is seeking to respond to several developments that have emerged since the standards were first introduced in 2014. Two of the key developments are the introduction of new insurance accounting standards and the IMF review of the New Zealand financial sector, which recommended closer adherence to the International Association of Insurance Supervisors’ Insurance Core Principles.

The draft ISS combines the five current solvency standards into a single standard. Combining the standards has created some definitional issues between general and life insurance contracts. The definitions outlined in the ISS mean that New Zealand general insurance products that have terms of more than one year, such as extended warranty insurances which usually have terms of 3-5 years, are considered long-term insurance and so would be subject to solvency standard requirements from the old life insurance standard.

Waiting for change

At this stage, there have been no changes to the existing calibration factors that are used to calculate the minimum solvency capital for general insurers. The ISS was not intended to alter capital requirements. The RBNZ will be undertaking a recalibration of the capital changes in stage two of the solvency standard review, which is expected to be done in 2022 and 2023. However, the standard includes a new capital charge for operational risk, which will impact the regulatory solvency position for general insurers.

Freeze frame: mandatory climate-related disclosures will capture the nine largest general insurers

The operational risk charge is calculated as three per cent of an insurer’s gross premium (or their claims liabilities, if these are higher), plus an additional charge for insurers who have annual premium growth that exceeds 20 per cent. For the 10 largest general insurers who comply with New Zealand solvency requirements, applying this charge to their last annual accounts would result in a 36 per cent decrease in their combined solvency ratios. This may suggest insurers could look to increase their capital levels, potentially by increasing the retention of any future profits.

The RBNZ is considering feedback from the submissions on the draft ISS and is aiming to publish a revised ISS by 1 October 2022. The draft ISS was originally due to come into force on 1 January 2022, but has been deferred until 1 January 2023.

Conduct bill on the horizon

The other piece of regulation on the horizon for New Zealand general insurance is the Financial Markets (Conduct of Institutions) Amendment Bill (CoFI), which will amend the Financial Markets Conduct Act 2013. The CoFI bill will require insurers to have a fair conduct program to ensure they treat customers fairly. It will also regulate sales incentives, with incentive targets likely to be banned. The CoFI bill is awaiting its second reading in parliament and is expected to pass into law in 2023.

In July, the Financial Markets Authority (FMA), which will be the regulator of insurers’ fair conduct programs under the CoFI bill, issued a report on how general insurers are responding to conduct risk. In particular, the report looked at whether general insurers had completed a set of specific FMA-requested tasks, relating to their conduct risk, commissions and incentives. The report found only two insurers had completed the tasks to the FMA’s satisfaction. This suggests general insurers will still have some work to do in meeting their regulatory requirements under CoFI once it is enacted.

Under pressure: RBNZ stress testing found insurers would be most affected by a reinsurance shock

Stress-test first reveals reinsurance weak link

The RBNZ recently released its findings of the first stress test it has undertaken on general insurers. It put the five largest insurers to the test covering three scenarios: a reinsurance market stress scenario, an economic downturn scenario and a severe weather events scenario.

The stress testing found insurers would be most impacted by the reinsurance market stress scenario. Under this scenario, it is assumed that due to catastrophic global events the global reinsurance market experiences a shock. The result of this shock is a 10 per cent reduction in reinsurance capacity, together with increasing reinsurance premiums and credit rating downgrades for reinsurers. Under this scenario, the New Zealand general insurance industry would fail the RBNZ’s regulatory solvency requirements if no mitigating actions were undertaken by insurers.

The reason for this result is the RBNZ’s requirement for general insurers to obtain reinsurance cover for expected losses from a 1:1000 earthquake event. For all other risks, reinsurance is needed only for expected losses from a 1:250-year event. This means that insurers who underwrite earthquake risks are reliant on reinsurers providing high levels of cover.

Tricky choice – cover the cost or exclude the risk

A reduction in global reinsurance capacity would mean that insurers would need to either raise capital to cover the reduced reinsurance capacity or reduce their exposure to earthquake risks. The RBNZ stress-testing results show that the additional capital that would need to be raised by the five largest insurers is $1.9 billion for a 10 per cent reduction in reinsurance capacity. Under this scenario, one potential mitigating option for insurers would be to exclude earthquake cover for property risks or provide it as a highly priced optional extra, as is the case in California. This scenario could lead to public pressure on the Government to carry all earthquake risks through the EQC, including commercial risks, which are currently not covered.

Future perspective: the NZ insurance landscape is well placed to navigate the challenges ahead

Earthquake Commission has an eye for fairness

Prior to the results of the RBNZ stress testing, the Government has announced it will be increasing the EQC cap for domestic properties, from the current $150,000 to $300,000 (plus GST). This increase will mean that the maximum EQC levies increase from $345 to $552. The change will come into effect for policies written from 1 October 2022. The Government has said it expects to see insurance premiums reduce, and that if insurers’ pricing does not behave as expected, then it is open to considering options, such as a competition study.

The increase in the EQC cap will reduce the private insurance industry’s exposure to domestic earthquake risks. This would reduce the magnitude of the reinsurance market test highlighted by the RBNZ stress testing, although it would be unlikely to change the underlying result. However, the majority of the domestic market is insured by either IAG or Suncorp. Both insurers have reinsurance programs covering their combined New Zealand and Australian risks. This means the change in the risk exposure for their New Zealand risks may not necessarily result in a reduction in their overall reinsurance costs. Internationally, reinsurance rates are also expected to increase over the next year. This is due to higher-than-usual numbers of natural catastrophe losses globally, as well as losses related to the COVID-19 pandemic.

Given these factors and the Government messaging, we expect the pricing of domestic insurance policies for the next few years to be under a higher-than-usual level of scrutiny. This, combined with the expected introduction of the CoFI legislation, will require insurers to provide more evidence they are treating customers fairly.

The future is agile

A wave of change is bearing down on the New Zealand general insurance industry and insurers will need to respond to several regulatory changes. These changes will increase the compliance costs for insurers. At the same time, insurance affordability will continue to remain a key issue. The insurance industry is well placed to respond to these changes, but will need to keep in mind the importance of a flexible approach in this fast-changing environment.

Other articles by

Ross Simmonds

Other articles by Ross Simmonds

More articles

RADAR FY2024 New Zealand Snapshot

Delve into our step-by-step report of the major events, trends and hot topics affecting the general insurance market across Aotearoa

Read Article

Elevated premiums and profits – what’s really going on in New Zealand?

A perfect storm may be brewing as Aotearoa community experience and insurer bottom lines collide. Ross Simmonds unpacks the issues

Read Article

Recent articles

Recent articles

More articles

Press release – Taylor Fry announces Canberra chief for government practice

An exciting new chapter for Taylor Fry with the launch of our office in the nation's capital and the appointment of Jeremy Smith-Roberts

Read Article

NSW Ministry of Health releases Taylor Fry report

Our evaluation of suicide prevention initiatives shows where they’re operating well and where access and follow-up care can be strengthened

Read Article